A parent and teen’s guide to affording summer programs

Posted by

Getting into a top-notch summer enrichment program, whether it’s a pre-college deep dive into neuroscience, a hands-on marine biology expedition, or a creative writing residency, can become a life-changing experience. These programs extend beyond traditional summer camps, giving participants a chance to explore their passions, build skills, and gain an advantage in the competitive college admissions landscape. You’ll meet like-minded peers, learn from instructors who are leaders in their field, and potentially come away with a clearer direction for your future.

But let’s be real. Once you find that perfect program, a new challenge often arises: the price tag.

While incredible, low-cost or free programs certainly exist, the unfortunate truth is that many of the most selective and specialized summer experiences come with hefty tuition or enrollment fees. For many students and their families, cost is the leading factor when deciding between programs.

Don’t let sticker shock close the door on an amazing opportunity. We’re here to tell you that there’s often a path to afford the program of your dreams. It just requires a little strategy, a lot of organization, and a healthy dose of persistence.

We invite you to shift your focus from “Can we afford this?” to “How can we fund this?”

Below, we break down five of the most common and effective ways students and parents can pay for a summer program, offering detailed step-by-step guidance and examples to make the process clear and, hopefully, achievable.

Scholarships

When most people think of scholarships, they picture huge, life-changing awards given for four years of college. While summer program scholarships aren’t nearly as common or widely publicized as those academic awards, they absolutely exist, and they’re your first and best funding source to explore. This “free money” can drastically reduce the total program cost.

The program and university connection (Start here!)

The first, best place to check for a scholarship is the program itself. If you’re considering a pre-college program, for example, the host universities or colleges may offer grants and scholarships to eligible students. These institutions seek to cultivate relationships with promising high school students, and offering financial aid is an effective way to attract top talent.

- Action step: Never assume a program's stated tuition is the final cost. Always, always, always inquire about financial aid directly with the program administration. Many programs want talented students regardless of their ability to pay, but you have to ask.

Sibling, group, and loyalty discounts

Don't overlook the simple discounts that can shave hundreds off the total price.

- Sibling and group discounts: Many summer camps and multi-week programs offer reduced tuition if you enroll a sibling or if a group of friends from the same school enrolls together. If you know other students interested in the program, coordinate with them.

- Loyalty discounts: Did you attend this program last year? Many providers offer a discount to returning students as a thank-you for their continued business.

The college credit connection

Here’s a crucial piece of insider information: Scholarship opportunities are significantly more likely for programs that award college credit.

Why? Because many financial aid structures and funds are designed to support education that results in recognized academic credit. If the program you’re eyeing offers a college-level course and grants, say, two transferable credits, it opens up a much wider pool of potential funding.

Important tip: When you're comparing programs, look specifically for the phrase "pre-college credit" or "transcripted course." This simple detail can unlock a number of funding avenues.

Tapping into community and state resources

Beyond the program itself, a dedicated search can uncover external scholarships specifically for enrichment.

- Local community programs: Check your community staples, like the YMCA or Boys & Girls Club — or the local parks and recreation department, for grants and scholarships. These organizations often have dedicated funds to ensure local youth can access educational and enriching summer activities.

- State subsidies: Some states earmark funds in their budgets to subsidize summer programs and camps, particularly those with a focus on education, STEM, or youth development. Local school districts or non-profit organizations often manage this funding, so check with your high school counselor.

National and specialty scholarships

A dedicated Google search or a talk with your counselor can reveal national organizations that offer financial aid for specific types of summer enrichment.

- Specialty funds: Organizations like the American Foreign Service Association High School Essay Contest (winner receives aid for an educational trip), the Garden Club of America (often funding nature/ecology camps), or The Happy Camper Project are great examples of niche funding sources.

- Need-based aid: Broader organizations like The Salvation Army and programs like the Neubauer Adelante Family Summer Scholars Program may offer scholarships or support for high-achieving students from low-income families attending rigorous programs.

Tips for applying to summer scholarships

Summer scholarship deadlines are often highly competitive, so approach them strategically:

- Apply early: Programs often allocate their scholarship funds on a rolling basis. Starting your search and application process well in advance — even in the fall or early winter — significantly improves your chances of securing aid before the funds run out.

- Be thorough: Read all eligibility requirements carefully. If they ask for an essay, a letter of recommendation, proof of financial need, and a transcript, submit all of it. A small oversight can disqualify an otherwise perfect application.

- Read the fine print: Some scholarships are flexible. For example, some awards might be used for expenses beyond tuition, like travel (a huge help for summer programs abroad) or required books and supplies. Know exactly what the funds can cover.

Leveraging your 529 tax savings account

A 529 college savings plan forms the cornerstone of many families’ higher education funding strategies. These accounts allow investments to grow tax-free; distributions are also tax-free when used for qualified education expenses. The great news? You can use a 529 account for more than college tuition.

The college credit requirement (again)

If your student is taking a transferable course from an eligible educational institution during the summer, the expenses you can cover with the 529 are comprehensive, covering more than the tuition.

What a 529 can cover

If your chosen program awards college credit, the 529 can cover a whole spectrum of costs that would otherwise come out of pocket, including:

- Program tuition: The main expense.

- Mandatory fees: Application fees, lab fees, technology fees, etc.

- Room and board: If the program includes housing and meals, these are eligible expenses.

- Books and supplies: The cost of any required textbooks, course materials, or special equipment needed for the class.

- Example: Jake's parents have a healthy 529 account. Jake wants to take an intensive one-week course in game design that grants 1 credit. The $3,000 total cost includes tuition, room, board, and software licensing fees. Because it offers a credit, his parents can withdraw the full $3,000 from the 529 plan, keeping their personal savings intact and maximizing the account's tax benefits.

While the primary goal of your summer program shouldn’t just be to get college credit, finding a program that offers it can certainly act as a powerful way to reduce your overall total cost. It turns a large expense into a qualified, tax-advantaged withdrawal.

Smart Tax Planning: Flexible Spending Accounts (FSAs)

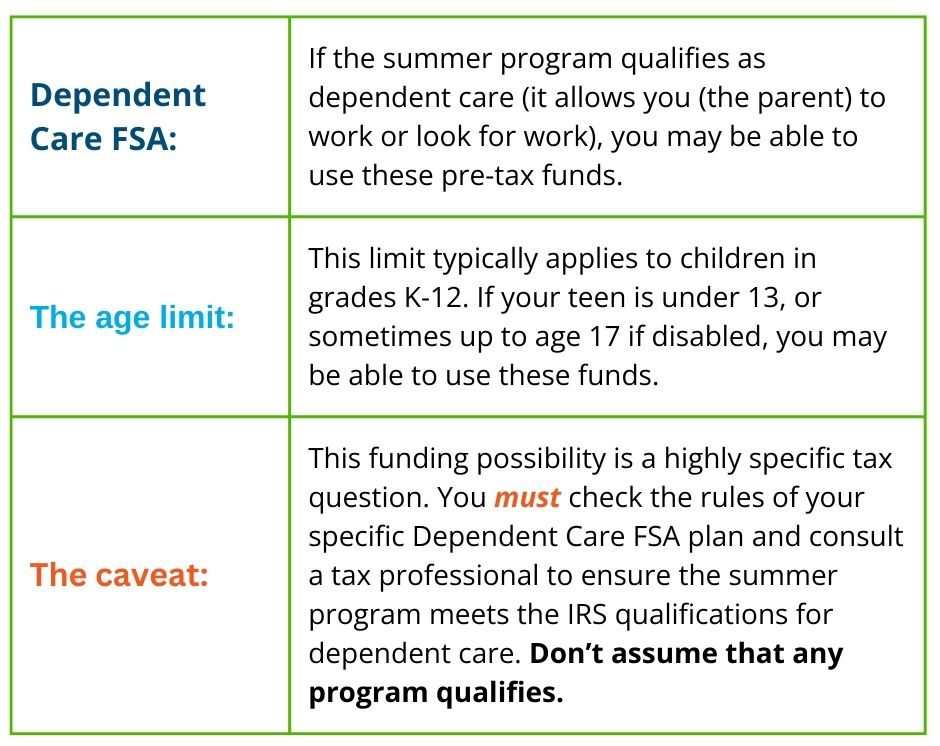

This often overlooked option can be a small, strategic win for parents. Some employers allow you to allocate part of your Flexible Spending Account (FSA) to help offset the cost of summer programs for your children. FSAs are accounts you put pre-tax money into to pay for certain out-of-pocket health care or dependent care costs.

Donations and gifts

If your preferred program doesn't offer college credit or financial aid — perhaps it’s an overseas service trip, a specialized arts workshop, or a research opportunity — you need to get creative. Now it’s time to lean into your network, storytelling ability, and community. Welcome to the realm of fundraising and crowd-sourcing.

Online fundraising campaigns

Online platforms like GoFundMe, Fundly, or social media campaigns are popular, effective ways to reach a wide audience. The key to success? Your story and the strategy behind it.

- Be clear and honest: Don't just post a picture and a dollar amount. Explain exactly where the money will go (e.g., "$1,500 for tuition, $500 for airfare, $200 for supplies"). Transparency builds trust.

- Tell a compelling story: Why is this program essential to your future? What do you hope to learn? How will it change your path?

- Example: Instead of saying, "I need money for a science camp," say, "This marine biology program in California is the only one that lets me work hands-on with endangered sea turtles. I’ve volunteered at the local aquarium for three years, and this opportunity will help me reach my career goal of becoming a marine conservationist. Your $50 donation helps me pay for my lab fees and one day save a turtle." Connect the donation to a clear outcome.

- Provide regular updates: Show donors how their contributions are helping. By posting pictures and updates during the program, you prove the value of their gift and encourage future support for you or others.

Writing to your circle and local businesses

Sometimes, the most direct approach is the most effective and involves a personalized touch that online platforms lack.

- Family and friends: Draft a polite letter or email to family members, close friends, or godparents, explaining the opportunity. A handwritten note often carries more weight. Ask for a "gift" towards your education. Many relatives would happily contribute $25 or $50 instead of buying you a random birthday or holiday gift.

- Local businesses and churches: Approach small, locally owned businesses that have a vested interest in community youth. Write a formal request outlining the program, your plans after college, and how this experience will make you a better future leader in the community. Frame it as a small, one-time sponsorship of a future professional.

The takeaway: Fundraising requires courage and a clear vision. When you do it with honesty and persistence, you’ll find that people are often eager to invest in a motivated, articulate young person.

Summer jobs and personal savings

Summer jobs and personal savings

While some summer enrichment programs run for several months, many are only a week or two long. Even the longer programs rarely consume the entire break. So, while your program might be the highlight of your summer vacation, you’ll probably have time for other activities — like a part-time job. And some of those earnings can help pay for your program.

Strategic timing and savings

The key? Strategic timing. Look for programs that start in late July or August, giving you the early part of summer to work, save, and earn.

Work and save: Commit to working for most of the summer and dedicating a fixed weekly amount to your "Program Fund."

Example: Leo gets a job at the local ice cream shop, working 20 hours a week for $15/hour. He earns $300/week. If he commits to setting aside $150/week, he saves $1,500 after 10 weeks. Even if this amount doesn’t cover the full cost, it may cover his airfare and supplies, or help bridge the gap after a scholarship is applied.

Year-round work: During the school year, working a few hours a week — babysitting, tutoring, refereeing, or at a weekend retail or restaurant job — can build up a significant savings cushion over nine months.

The dual benefit

Working to pay for your program is a win-win situation.

- Financial independence: You should feel a sense of accomplishment and ownership when you pay for an experience with your hard-earned money. This personal investment increases the value of the experience.

- Resume building: A summer job provides another useful, concrete item for your college resume. Colleges appreciate students who take initiative, manage their time, and demonstrate responsibility. Telling an admissions officer, "I saved up the majority of the tuition for my summer program myself," sends a powerful message about your work ethic.

The power of combination: All of the above!

Want the essential truth about funding a pricey summer program? For most students, no single method will cover the full cost. The most successful funding strategies are almost always a mosaic — a clever combination of two, three, or even all five options.

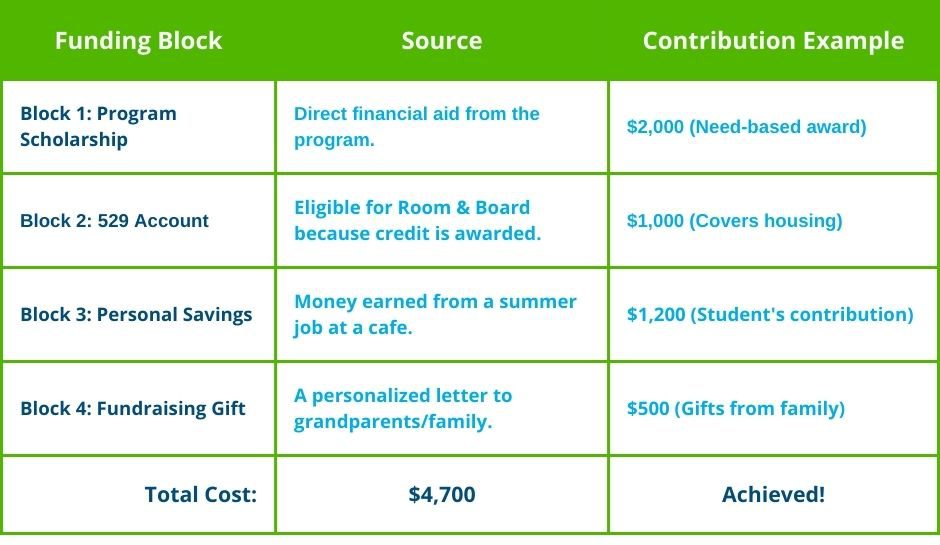

The financial stack

Think of your funding goal as a stack of building blocks. You need to stack up enough sources to reach the total tuition height.

When you break down the larger number into smaller, manageable chunks, the goal suddenly feels achievable. Instead of feeling like an impossible hurdle, a $4,700 program looks like four separate, smaller goals.

How to start the conversation

Parents and teens, this process starts with an open, honest discussion.

- Teens: Do your research. Find the program, get the cost, and immediately identify the scholarship/financial aid options. Present your parents with a clear proposal, not just a wish list. Say, "The program costs $5,000. They offer financial aid, which I've applied for. I plan to work and save $1,500 myself. Can we discuss how to cover the remaining amount?"

- Parents: Discuss what your family is realistically able to contribute. Be clear about the expectations for the teen's involvement. If you can cover half the cost, tell them you’ll match every dollar they earn or raise. This shared investment teaches invaluable lessons in financial literacy and responsibility.

Part II: Mastering the Application and Fundraising Narrative

Once you know the five core funding options, the next step is execution. Getting the money relies heavily on how well you tell your story and how meticulously you handle the application process.

The scholarship application game plan

Securing a scholarship is like applying for a mini-job — you must present yourself as the best candidate for the available funds. Since scholarship deadlines are often competitive, being prepared and organized is essential.

The prep work: Before you write

- Create a "Scholarship Master File": Keep a digital folder containing all the standard documents you'll need for any application:

- Transcripts: Unofficial and official copies.

- Financial documents: (For need-based aid) The last two years of tax returns or specific financial aid forms (like the FAFSA or CSS Profile if applicable to the program).

- Standard essay drafts: Have drafts ready for prompts like "Describe a challenge you overcame," "Why this field interests you," and "Your future career goals."

- Recommendation letters: Ask 2-3 teachers (one STEM, one Humanities, one elective/extracurricular advisor) to write general letters of recommendation. They can then quickly tailor these for specific programs.

- Verify eligibility: Read the fine print! Some scholarships are restricted by state, school district, intended major, or even extracurricular activities (e.g., "for students who participate in debate club"). Do not waste time applying if you don't meet every requirement.

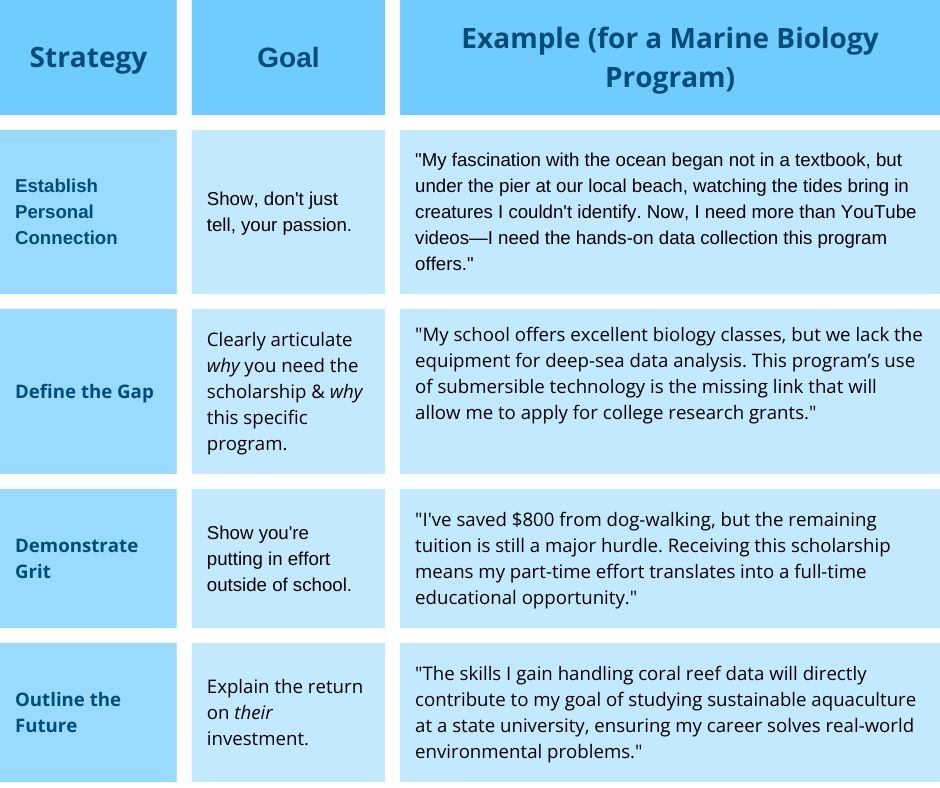

Tips for a high-impact essay

Scholarship providers are looking for passionate students who will use the opportunity wisely. Your essay must demonstrate a clear connection between the program and your future.

Crafting a compelling fundraising campaign

If you pursue the "Donations and Gifts" route (Section 4), your success hinges on one thing: the narrative. Donors aren’t simply paying tuition; they are investing in a dream.

The three pillars of a successful campaign

A strong fundraising page or letter must clearly and immediately answer these three questions:

- The What: What is the program, and how much does it cost? (Be specific!)

- The Why: Why is this program essential to your development and future goals? (Emotion and aspiration.)

- The How: How will the money be spent, and how will the donor receive updates? (Transparency and accountability.)

Campaign scenario: The aspiring architect

Let's look at Maria, who wants to attend a competitive four-week urban design intensive program in New York City.

Leveraging the Local Community

Remember to look beyond online platforms and tap into your local resources. When approaching local businesses, you are not begging; you are proposing a sponsorship.

- The proposal: Create a professional, one-page document.

- Headline: "Sponsor a Future Leader: Help [Student Name] Attend the [Program Name]!"

- Offer: In exchange for a $250 donation, offer to volunteer for a day at their business or include their business logo on any printed materials you create for the program (if allowed).

- Follow-Up: A simple handshake and a promise to report back with gratitude goes a long way toward securing local funding.

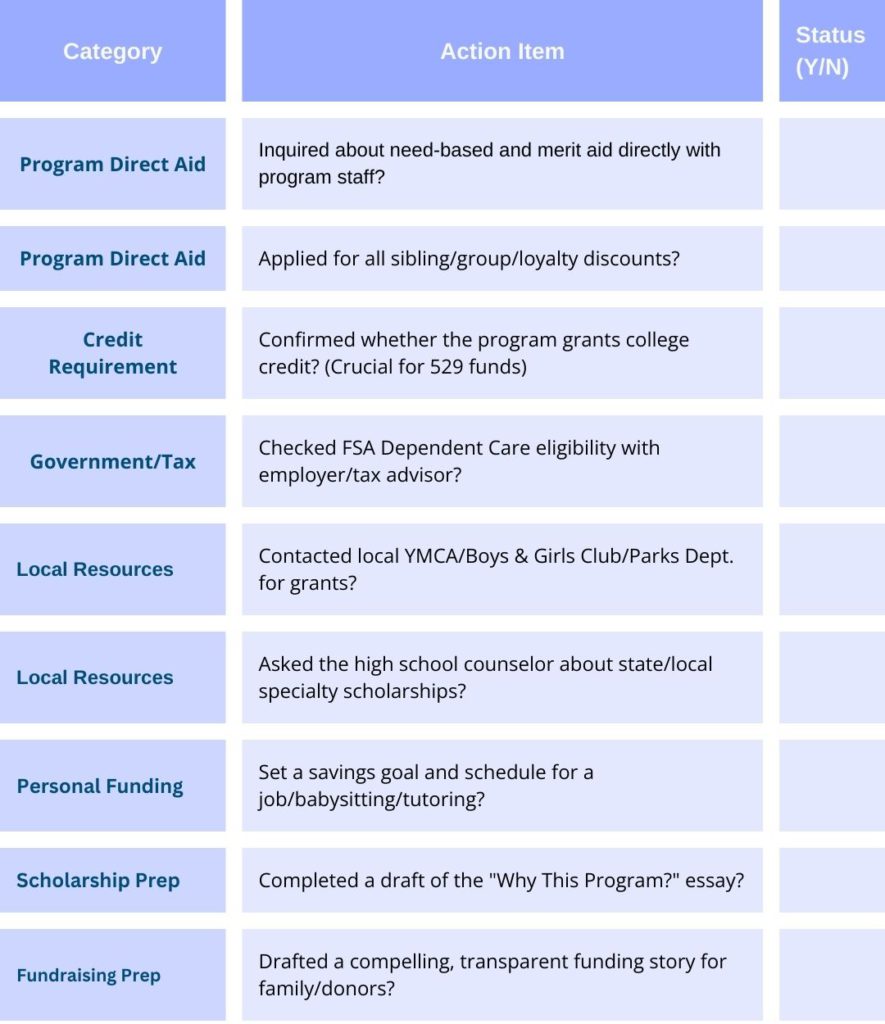

Final checklist for success

To tie everything together and ensure you haven't left any funding stone unturned, use this final checklist:

By following this strategic, multi-layered approach, you transform the overwhelming cost into a manageable project. You show the world—and your future college—that you are resourceful, responsible, and absolutely determined to succeed.

The investment is worth it

While the focus here is on the money, don't lose sight of the incredible value you’re purchasing. A summer enrichment program is not just a vacation; it’s an investment in future academic success, career clarity, and personal growth.

You’re getting a head start on college-level learning, building a professional network before you even set foot on a college campus, finding your voice and confirming your passion.

With a combination of scholarships, tax-advantaged savings, community support, and honest work, any student can fund the summer program of their dreams. Start the research, make the plan, and put in the effort — the life-changing experience waiting for you is worth every bit of it. Need some inspiration? Check out our latest Guide to Summer Programs.

Blog Categories

- Career Advice

- College Admissions

- Colleges & Universities

- Financial Aid and Scholarships

- For Counselors

- For Parents

- For Students

- Gap Years

- Mental Health and Wellness

- Online Learning

- Performing and Visual Arts

- STEM Majors and More

- Summer Programs

- Teen Volunteering

- Trade & Vocational Schools

- Tutoring & Test Prep

Organization with listings on TeenLife? Login here

Register for Free

We’re here to help you find your best-fit teen-centered academic and enrichment opportunities.

Forgot Password

"*" indicates required fields

Summer jobs and personal savings

Summer jobs and personal savings