Your essential guide to FAFSA

Posted by

The FAFSA (Free Application for Federal Student Aid) is the single most important document for students seeking financial assistance for college. This application process has undergone a massive overhaul in recent years (known as FAFSA Simplification) and continues to receive updates.

Here’s a comprehensive guide for parents, high school seniors, and current college students on the FAFSA, including the specific updates for the 2026-2027 application cycle, which started on October 1.

What is the FAFSA?

The federal government uses the FAFSA to determine a student’s eligibility for federal, state, and institutional financial aid. This document serves as the foundation for nearly all need-based financial assistance in the U.S.

By completing the FAFSA, students can qualify for:

- Grants: Money you don’t need to pay back (e.g., Pell Grants)

- Scholarships: Awards from state governments or individual colleges

- Work-study: A program that allows students to earn money through part-time jobs while attending college

- Federal student loans: Money you must repay, typically with lower interest rates and more flexible repayment options than private loans, after graduation

Why parents and students need to file the FAFSA

It’s important to file the FAFSA every year you plan to attend college, regardless of your family’s income. Here’s why:

- Access to all aid: Without a completed FAFSA, you’re automatically ineligible for federal aid. Most state and college-specific aid also requires it, even for merit-based scholarships that may have a need-based component.

- Federal loans: Even higher-income families who don’t qualify for grants often need the FAFSA to access Federal Direct Student Loans, which are usually the best and safest borrowing option.

- Contingency: Life’s unpredictable. If your family’s financial situation changes mid-year, like a job loss or medical expenses, your college’s financial aid office needs your FAFSA on file to make adjustments and provide additional support.

- It’s free: The form is completely free to submit.

Updates to the 2026-2027 FAFSA application

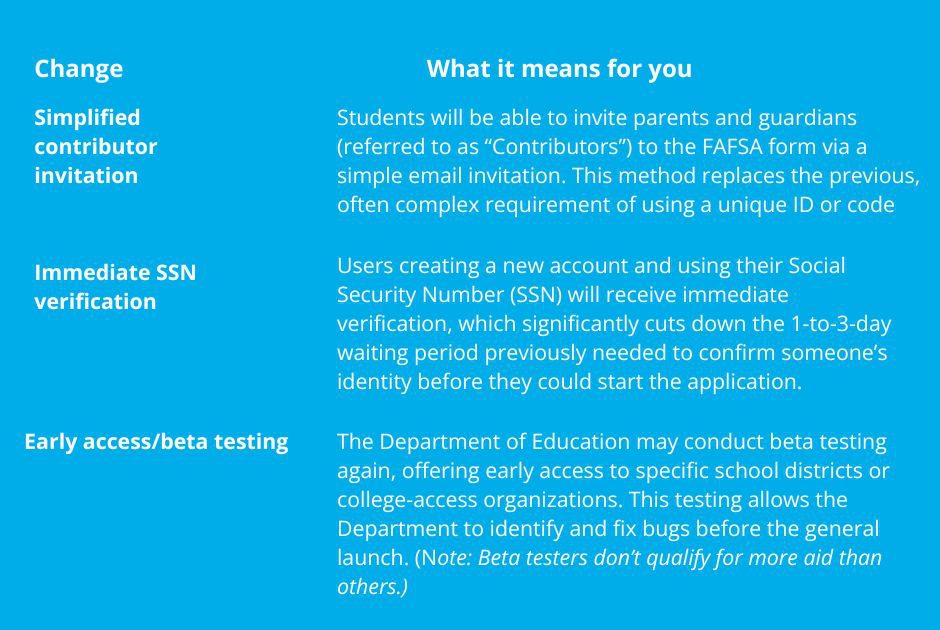

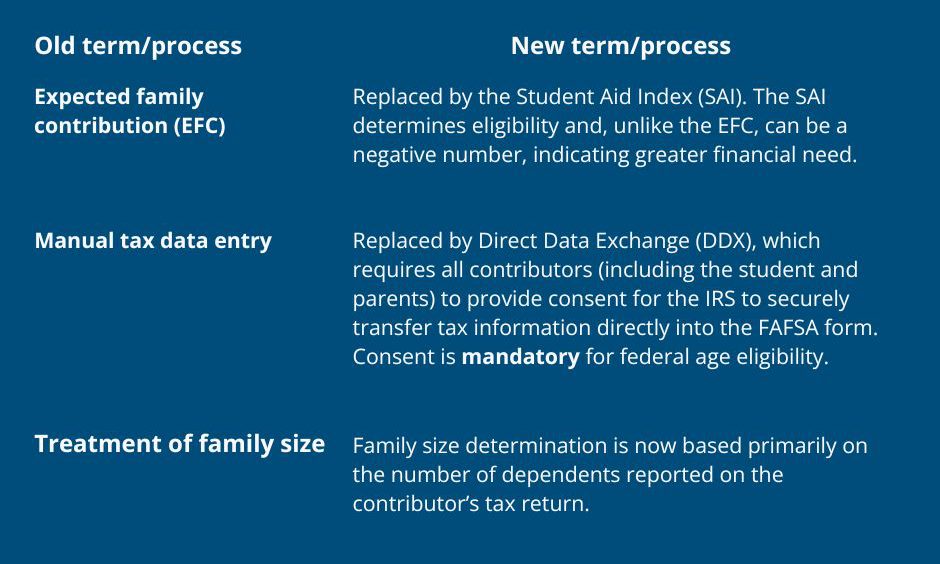

The FAFSA has been simplified in recent cycles, with fewer questions and better data integration. The 2026-2027 application builds on this foundation, with several key process improvements designed for greater user convenience.

Broader FAFSA simplification (since 2024-2025)

If you’ve filled out the FAFSA in the past, you may notice other changes, which have become standard for the 2026-2027 cycle.

When to apply

The FAFSA application uses prior-prior year tax data. In other words, if you’re completing it for the 2026-2027 school year, you’re using 2024 tax information. The FAFSA application window opened on October 1. Parents and students can start a new form, edit existing forms, or accept an invitation on the official website.

And here’s a tip: Although the application window is technically 18 months, with a federal closing deadline of June 30, 2027, the sooner you apply, the greater the likelihood you’ll get the maximum amount for which you qualify. Waiting even just a few weeks to apply could mean missing out on limited state or institutional grants.

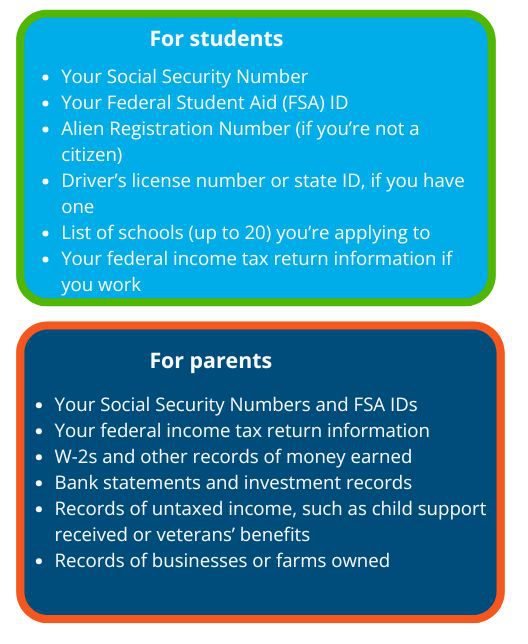

There are many checklists available to help you gather all the information you’ll need (whether you’re a student or parent) to complete the FAFSA application.

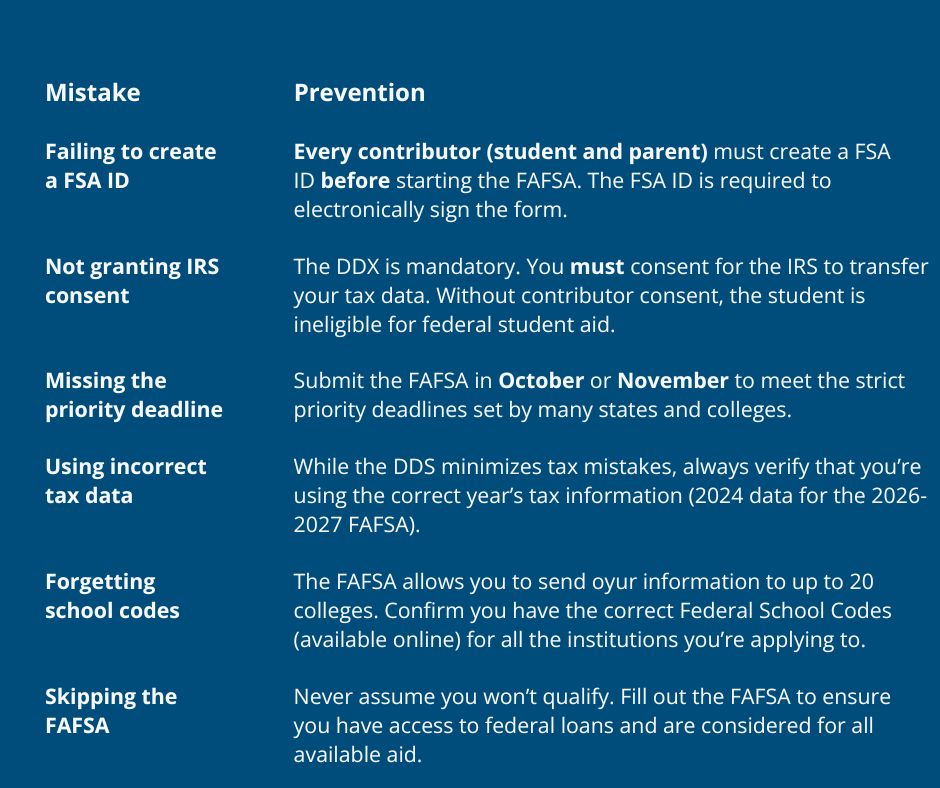

Mistakes to avoid

Filling out the FAFSA is easier than ever, but you want to avoid these common mistakes.

FAQs for parents and students

If my parents are divorced, which parent should complete the FAFSA?

Report the information of the parent who provided the most financial support during the prior 12 months. This requirement differs from the previous rule, which focused on the parent the student lived with the most. Not sure which parent to include? Check out the “Who’s My FAFSA Parent” wizard.

Do I need an FSA ID if I don’t have a Social Security Number (SSN)?

Yes. All contributors, regardless of immigration status, must create an FSA ID to access and sign the form. While SSN users get immediate verification, non-SSN users will still complete the form but must complete a manual identity verification process.

What is a “Contributor,” and do they all need an FSA ID?

A Contributor is any individual required to provide information and consent on the FAFSA and typically includes the student and one or two parents/stepparents. Every contributor must have their own FSA ID.

Can I complete the FAFSA on my phone?

Yes! The modernized FAFSA is designed to be mobile-friendly, making it easier to complete from a computer, tablet, or smartphone.

My college is asking for another financial aid form. Why?

Some colleges, especially private institutions, require the CSS Profile in addition to the FAFSA to gather more detailed financial aid information. Contact your school’s financial aid office if you have questions.

Blog Categories

- Career Advice

- College Admissions

- Colleges & Universities

- Financial Aid and Scholarships

- For Counselors

- For Parents

- For Students

- Gap Years

- Mental Health and Wellness

- Online Learning

- Performing and Visual Arts

- STEM Majors and More

- Summer Programs

- Teen Volunteering

- Trade & Vocational Schools

- Tutoring & Test Prep

Organization with listings on TeenLife? Login here

Register for Free

We’re here to help you find your best-fit teen-centered academic and enrichment opportunities.

Forgot Password

"*" indicates required fields